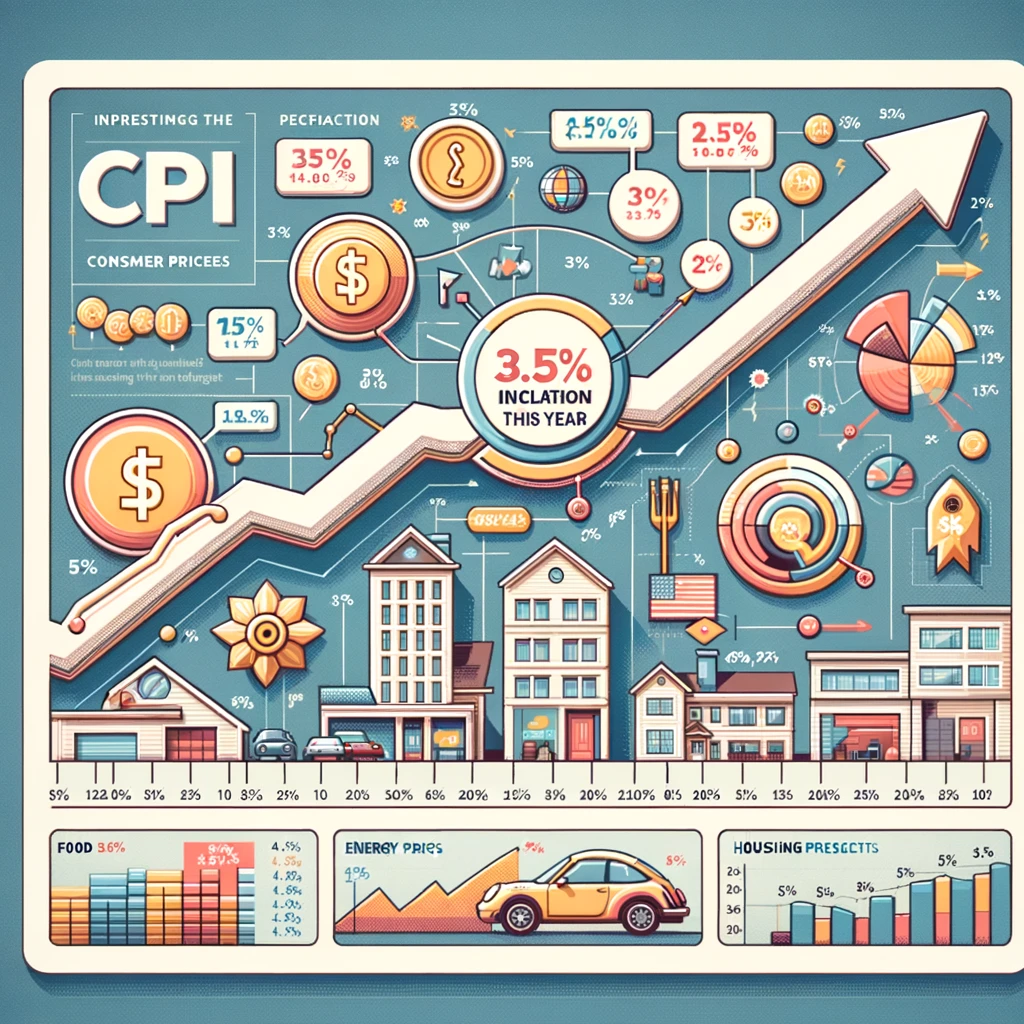

The CPI (Consumer Price Index) Report is a critical economic indicator, offering insight into the inflation trends by tracking the changes in the prices paid by consumers for goods and services. The latest report, indicating a 3.5% rise in consumer prices this year, provides a vital snapshot of the current economic climate, reflecting how the cost of living is adjusting in response to various economic forces.

A 3.5% increase in consumer prices is significant, suggesting a notable shift in the economic landscape that affects consumers, businesses, and policymakers alike. This rise in the CPI indicates that, on average, consumers are paying 3.5% more for a basket of goods and services than they did a year ago. This change can be attributed to various factors, including supply and demand dynamics, currency valuation, and external economic influences like geopolitical events or global market trends.

For consumers, this uptick in inflation means a direct impact on purchasing power. As prices rise, the same amount of money buys less, affecting household budgets and spending habits. Individuals may need to adjust their expenditures, prioritizing essential purchases or seeking more affordable alternatives to maintain their standard of living.

Businesses, too, feel the ripple effects of rising consumer prices. They may face higher costs for raw materials and services, which can lead to increased product prices to maintain profit margins. However, if consumers are tightening their belts, businesses might find it challenging to pass on these costs, potentially squeezing their profit margins.

From a policy perspective, a 3.5% increase in inflation is a critical signal for central banks and government officials. It might prompt them to adjust monetary policies to keep inflation within a target range, ensuring economic stability. For instance, central banks may consider altering interest rates to manage economic growth and control inflationary pressures.

The sectors impacted by inflation can vary, with some experiencing higher price increases than others. For example, energy and food prices often have significant volatility, and changes in these areas can disproportionately affect the overall inflation rate. Therefore, understanding the breakdown of inflation across different categories is crucial for a comprehensive analysis of the economic landscape.

Moreover, the inflation data needs to be contextualized within the broader economic environment. Factors like unemployment rates, wage growth, and international trade dynamics all interplay with inflation, influencing and being influenced by the cost of living.

Looking ahead, the future trajectory of inflation is a subject of keen interest for economists, investors, and policymakers. Predictions and analyses will hinge on a range of variables, including fiscal policies, market trends, and unforeseen global events. The impact on long-term economic planning and strategy, both at an individual and institutional level, is profound, emphasizing the importance of closely monitoring these trends.

The 3.5% rise in consumer prices as indicated by the CPI report is more than just a statistic; it’s a reflection of the economic forces at play, impacting every facet of the economy from the individual consumer to the broader governmental strategy. As such, it plays a pivotal role in shaping economic policies, business strategies, and the everyday lives of citizens, underlining the interconnected nature of modern economies.